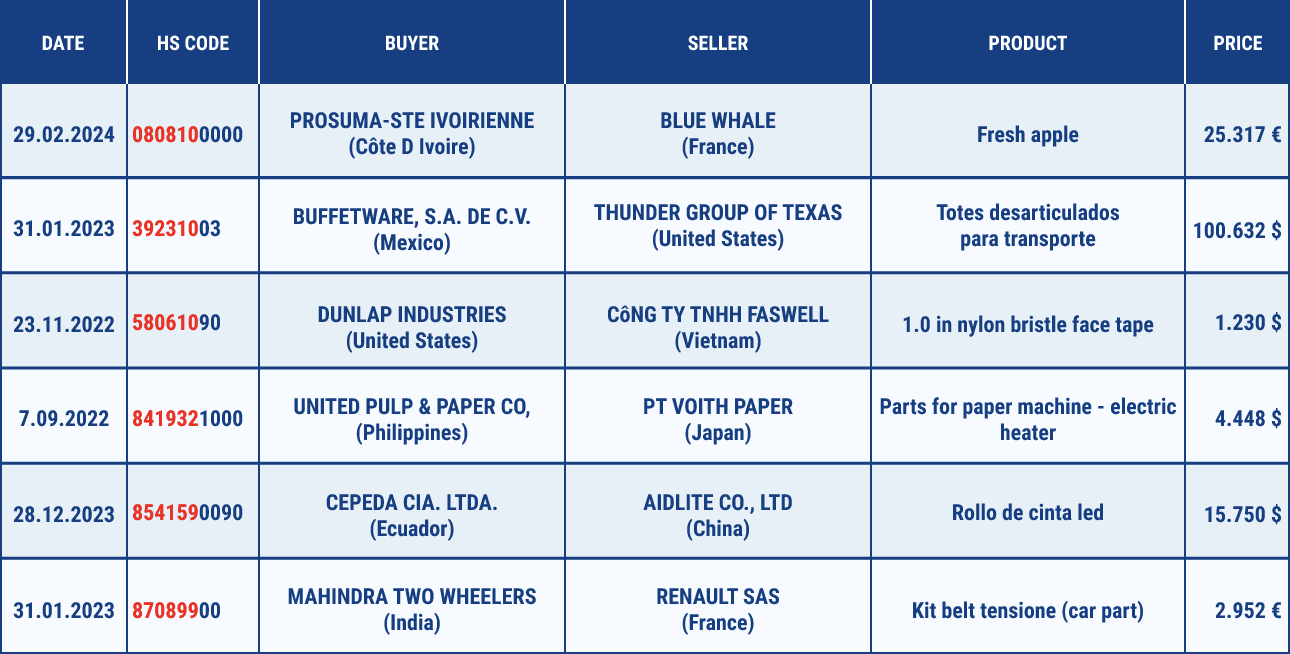

The Harmonized Commodity Description and Coding Systems generally referred to as "Harmonized System" or simply "HS Code" is a 6-digit standardized numerical method of classifying traded products developed and maintained by the World Customs Organization.

The Harmonized System Nomenclature (HS) forms the basis of all countries’ tariff Schedule all over the world. Nomenclature actually means the systematical numbering or naming of all internationally traded products according to international rules and interpretations. The Harmonized System constitutes a universal foundation for international trade statistics and all countries’ customs tariffs. The Harmonized System, whose official name is the Harmonized Commodity Description and Coding System, is an international classification system used for all internationally traded commodities. In the Harmonized System, every traded product is classified in accordance with certain logical and systematical framework. Products are registered in customs on the basis of these codes. Every product/product group has a HS Code. All traded commodities are processed in customs on the basid of these codes. HS Code is a universal trading language for products and is an indispensable instrument for both product coding and international trade. HS Code can be defined as the “identification number” of all products in customs procedures.The system is used by more than 200 countries and economies as a basis for the collection of international trade statistics. Besides, HS numbers are used by customs authorities around the world to identify products for the application of customs duties, taxes and regulations. Over 98 % of world trade is classified in terms of the HS.

The regulations regarding the Harmonized System in international level are carried out by World Customs Organization (WCO). WCO regulates customs implementations and provides uniformity in member countries. WCO makes comprehensive changes in the Harmonized System approximately every 5 year. As a case in point, WCO made thorough changes in the Harmonized System in 1992, 1996, 2002, 2007 and 2012. The underlying reason of these changes can be described as the product-coding of newly-entrant products to the market, first and foremost in information technologies, the incorportation of the codes of products whose trade volume is respectively low. Every product exported or imported from a country is given a HS code.

In the world, 207 countries and economies make use of this system. The list of countries/economies using the Harmonized System can be reached on the website of World Customs Organization.

The HS classification system is defined by World Custom Organization at the 2, 4, and 6 digit level.

The Harmonized System is a classification system comprised of 21 sections and 96 chapters. Chapter is the name for the 2-digit code in Harmonized System. Each chapter is denoted by a 2-digit code which is further divided into several 4 digit codes, which is called headings.These headings (4 digit code) are subdivided into 6 digit codes, which is called sub-headings. Chapters, which consist of 2-digit codes, is divided into headings (4-digit codes) and each heading is divided into sub-headings (6-digit codes). In other words, 4-digit headings are created by adding 2-digit to 2-digit chapters, and 6-digit sub-headings are formed through adding 2-digit to 4-digit headings.

HS Code, up to 6 digit level is followed internationally and is common to all countries. In every country’s tariff Schedule that are using the Harmonized System, 2-digit, 4-digit and 6-digit codes are the same all over the world. In other words, these codes represent the same product/product group in these countries. For instance, HS Code ‘071120’ is “olive” in all countries’ customs.

HS Code is 6 digits long.The codes that have more than 6-digit in the Tariff Schedules can be arranged and detailed by the countries according to their needs for a variety of reasons (e.g. to obtain more detailed statistics, to apply customs duties on the basis of more detailed product codes). As a case in point, HS Code code for lentil is 071340 in all countries. However, every country can use different codes for their own needs to differentiate the types of lentils such as seeds for sowing, green lentil and red lentil after the 6-digit code HS Code.

| Country | Turkiye | USA | Canada |

|---|---|---|---|

| Hs Code | 0713.40 | 0713.40 | 0713.40 |

| Seeds for sowing | 0713.40.00.00.11 | 0713.40.10.00 | 0713.40.00.10 |

| Green | 0713.40.00.00.12 | 0713.40.10.10 | 0713.40.00.91 |

| Red | 0713.40.00.00.13 | 0713.40.10.30 | 0713.40.00.92 |

| Other | 0713.40.00.00.19 | 0713.40.10.80 | 0713.40.00.99 |

As can be seen in the Table above, lentil is coded as 071340 in all three countries. However, species of lentils can differ after 6-digit code.Each country is allowed to add additional digits in these international HS codes to suit their national statistical or trading needs. For example 10 digits are used in EU, USA, South Korea, Canada and China, 12 digits are used in Turkiye, 8 digits are used in India, 9 digits are used in Moldova and Japan to suit the national requirements.

In some cases, after 6-digit codes both product-codes and detailed product-codes can be different. For example, after 6-digit code for apple, Turkiye and USA utilize different codes and classifications for apple whose GTIP code is 080810 in both countries.

| Turkiye | Turkiye | USA | USA |

|---|---|---|---|

| 0808.10 | - Apples | 0808.10 | - Apples |

| 0808.10.10.00.00 | - - Cider apples, in bulk, from 16 September to 15 December | 0808.10.00.30 | - - Valued not over 22¢ per kg |

| - - Others | - - Valued not over 22¢ per kg | ||

| 0808.10.80.00.11 | - - - Golden apples | 0808.10.00.45 | - - - Certified Organic |

| 0808.10.80.00.13 | - - - Starking apples | 0808.10.00.65 | - - - Other |

| 0808.10.80.00.14 | - - - Starkrimson apple | ||

| 0808.10.80.00.19 | - - - Others |

As can be seen in the Table above, the detailed classification of products after the 6-digit code may also differ in terms of the number of digits (number of codes) in countries’ customs tarif schedules. The number of digits used by countries to code products in detail can differ among countries. For instance, the most detailed codes used to classify products are 12-digit in Turkiye, 10-digit in USA, the European Union (EU), South Korea, Canada and China, 9-digit in Japan and Moldovia, and 8-digit in India.

Internationally traded products and commodities are classified not one by one but according to their genre/type and qualities, and certain products and commodities that have speciality or have higher shares in trade are categorized in a more distinctive fashion in this coding system. Particularly, detailed classifications are made after 6-digit codes according to weight/share of the products/product groups in (international) trade. For example, funegreek, which is a kind of sauce, is not coded separately on quite a few countries’ customs tariff schedules; but, it is included in “Others” category, which is the sub-group/category of 6-digit code “210390” (Other Sauces and …..). However, since funegreek has a wider use and demand in Turkiye than other countries, it is classified with code “210390.90.00.12”. Coding of funegreek in Turkiye and Canada’s customs tariff schedule is examined in the following table.

| TURKIYE | TURKIYE | CANADA | CANADA |

|---|---|---|---|

| 2103.90 | Sauces And Preparations Therefor, ; Mixed Condiments And Mixed Seasonings | 2103.90 | Sauces And Preparations Therefor, ; Mixed Condiments And Mixed Seasonings |

| .... | .... | .... | .... |

| 210390.90.00.12 | Funegreek | .... | .... |

| .... | .... | 210390.90.90 | Others |

| 210390.90.00.18 | Others |

As can be noticed in the Table above, while the detailed code for funegreek is 210390.90.00.12 in Turkiye, Canada uses 210390.90.90 (other sauces) as the detailed code for funegreek.

In Harmonized System, products are classified/categorized horizontally and vertically according to rankings such as crude and natural products, unprocesssed, semi-processed and processed products. This system can be seen in the whole tariff schedule. For instance, while “Polymers of ethylene, in primary forms” (crude product) is coded in heading 3901, “Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics” (processed product) are located in heading 3924.

Another example is that “Unwrought aluminum” (crude product) is coded in heading “7601”, whereas “Aluminum plates, sheets and strip, of a thickness exceeding 0.2 mm” (semi-processed product) are in heading 7606 and “Table, kitchen or other household articles ” (processed product) are located in heading 7615.

Another important feature regarding the classification in Harmonized System is the products are classified according to materials in chapters 01-83 and classified according to function in chapters 84-97.

With a view to ensuring uniformity of interpretations as regards the Harmonized System Nomenclature, WCO issues Harmonized System Explanatory Notes, which contain WCO’s official interpretations on the subject. The said notes are renewed and issued in English and French every 5 year. These notes are comprised of the following information on:

Nevertheless, these notes, except for Sections and Chapter notes, are not legally binding.

| SECTION I | Live Animals; Animal Products |

| Chapter 01 | Live animals |

| Chapter 02 | Meat and edible meat offal |

| Chapter 03 | Fish and crustaceans, molluscs and other aquatic invertebrates |

| Chapter 04 | Dairy produce; birds eggs; natural honey; edible products of animal origin, not elsewhere specified or included |

| Chapter 05 | Products of animal origin, not elsewhere specified or included |

| SECTION II | Vegetable Products |

| Chapter 06 | Live trees and other plants; bulbs, roots and the like; cut flowers and ornamental foliage |

| Chapter 07 | Edible vegetables and certain roots and tubers |

| Chapter 08 | Edible fruit and nuts; peel of citrus fruit or melons |

| Chapter 09 | Coffee, tea, maté and spices |

| Chapter 10 | Cereals |

| Chapter 11 | Products of the milling industry; malt; starches; inulin; wheat gluten |

| Chapter 12 | Oil seeds and oleaginous fruits; miscellaneous grains, seeds and fruits; industrial or medicinal plants; straw and fodder |

| Chapter 13 | Lac; gums, resins and other vegetable saps and extracts |

| Chapter 14 | Vegetable plaiting materials; vegetable products not elsewhere specified or included |

| SECTION III | Animal or Vegetable Fats and Oils and Their Cleavage Products; Prepared Edible Fats; Animal or Vegetable Waxes |

| Chapter 15 | Animal or vegetable fats and oils and their cleavage products prepared edible fats; animal or vegetable waxes |

| SECTION IV | Prepared Foodstuffs; Beverages, Spirits, and Vinegar; Tobacco and Manufactured Tobacco Substitutes |

| Chapter 16 | Preparations of meat, of fish or of crustaceans, molluscs or other aquatic invertebrates |

| Chapter 17 | Sugars and sugar confectionery |

| Chapter 18 | Cocoa and cocoa preparations |

| Chapter 19 | Preparations of cereals, flour, starch or milk; bakers' wares |

| Chapter 20 | Preparations of vegetables, fruit, nuts or other parts of plants |

| Chapter 21 | Miscellaneous edible preparations |

| Chapter 22 | Beverages, spirits and vinegar |

| Chapter 23 | Residues and waste from the food industries; prepared animal feed |

| Chapter 24 | Tobacco and manufactured tobacco substitutes |

| SECTION V | Mineral Products |

| Chapter 25 | Salt; sulphur; earths and stone; plastering mater ials, lime and cement |

| Chapter 26 | Ores, slag and ash |

| Chapter 27 | Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes |

| SECTION VI | Products of The Chemical or Allied Industries |

| Chapter 28 | Inorganic chemicals; organic or inorganic compounds of precious metals, of rare-earth metals,of radioactive elements or of isotopes |

| Chapter 29 | Organic chemicals |

| Chapter 30 | Pharmaceutical products |

| Chapter 31 | Fertilizers |

| Chapter 32 | Tanning or dyeing extracts; dyes, pigments, paints, varnishes, putty and mastics |

| Chapter 33 | Essential oils and resinoids; perfumery, cosmetic or toilet preparations |

| Chapter 34 | Soap, organic surface-active agents, washing preparations, lubricating preparations, artificial waxes, prepared waxes, polishing or scouring preparations, candles and similar articles, modeling pastes, "dental waxes" and dental preparations with a basis of plaster |

| Chapter 35 | Albuminoidal substances; modified starches; glues; enzymes |

| Chapter 36 | Explosives; pyrotechnic products; matches; pyrophoric alloys; certain combustible preparations |

| Chapter 37 | Photographic or cinematographic goods |

| Chapter 38 | Miscellaneous chemical products |

| SECTION VII | Plastics and Articles thereof Rubber and Articles thereof |

| Chapter 39 | Miscellaneous chemical products |

| Chapter 40 | Plastics and articles thereof |

| SECTION VIII | Raw Hides and Skins, Leather, Furskins and Articles thereof; Saddlery and Harness; Travel Goods, Handbags and Similar Containers; Articles Of Animal Gut (Other Than Silkworm Gut) |

| Chapter 41 | Raw hides and skins (other than furskins) and leather |

| Chapter 42 | Articles of leather; saddlery and harness; travel goods, handbags and similar containers; articles of animal gut (other than silkworm gut) |

| Chapter 43 | Furskins and artificial fur; manufactures thereof |

| SECTION IX | Wood and Articles of Wood; Wood Charcoal; Cork and Articles of Cork; Manufacturers of Straw, of Esparto or of Other Plaiting Materials; Basketware and Wickerwork |

| Chapter 44 | Wood and articles of wood; wood charcoal |

| Chapter 45 | Cork and articles of cork |

| Chapter 46 | Manufactures of straw, of esparto or of other plaiting materials; basketware and wickerwork |

| SECTION X | Pulp of Wood or of Other Fibrous Cellulosic Material; Waste and Scrap of Paper or Paperboard; Paper and Paperboard and Articles Thereof |

| Chapter 47 | Pulp of wood or of other fibrous cellulosic material; waste and scrap of paper or paperboard |

| Chapter 48 | Paper and paperboard; articles of paper pulp, of paper or of paperboard |

| Chapter 49 | Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans |

| SECTION XI | Textile and Textile Articles |

| Chapter 50 | Silk |

| Chapter 51 | Wool, fine or coarse animal hair; horsehair yarn and woven fabric |

| Chapter 52 | Cotton |

| Chapter 53 | Other vegetable textile fibers; paper yarn and woven fabric of paper yarn |

| Chapter 54 | Man-made filaments |

| Chapter 55 | Man-made staple fibers |

| Chapter 56 | Wadding, felt and nonwovens; special yarns, twine, cordage, ropes and cables and articles thereof |

| Chapter 57 | Carpets and other textile floor coverings |

| Chapter 58 | Special woven fabrics; tufted textile fabrics; lace, tapestries; trimmings; embroidery |

| Chapter 59 | Impregnated, coated, covered or laminated textile fabrics; textile articles of a kind suitable for industrial use |

| Chapter 60 | Knitted or crocheted fabrics |

| Chapter 61 | Articles of apparel and clothing accessories, knitted or crocheted |

| Chapter 62 | Articles of apparel and clothing accessories, not knitted or crocheted |

| Chapter 63 | Other made up textile articles; sets; worn clothing and worn textile articles; rags |

| SECTION XII | Footwear, Headgear, Umbrellas, Sun Umbrellas, Walking Sticks, Seatsticks, Whips, Riding-Crops and Parts Thereof; Prepared Feathers and Articles Made Therewith; Artificial Flowers; Articles of Human Hair |

| Chapter 64 | Footwear, gaiters and the like; parts of such articles |

| Chapter 65 | Headgear and parts thereof |

| Chapter 66 | Umbrellas, sun umbrellas, walking sticks, seatsticks, whips, riding-crops and parts thereof |

| Chapter 67 | Prepared feathers and down and articles made of feathers or of down; artificial flowers; articles of human hair |

| SECTION XIII | Articles Of Stone, Plaster, Cement, Asbestos, Mica Or Similar Materials; Ceramic Products; Glass and Glassware |

| Chapter 68 | Articles of stone, plaster, cement, asbestos, mica or similar materials |

| Chapter 69 | Ceramic products |

| Chapter 70 | Glass and glassware |

| SECTION XIV | Natural Or Cultured Pearls, Precious Or Semiprecious Stones, Precious Metals, Metals Clad With Precious Metal, And Articles Thereof; Imitation Jewelry; Coin |

| Chapter 71 | Natural or cultured pearls, precious or semi-precious stones,precious metals, metals clad with precious metal and articles thereof; imitation jewelry; coin |

| SECTION XV | Base Metals And Articles Of Base Metal |

| Chapter 72 | Iron and steel |

| Chapter 73 | Articles of iron or steel |

| Chapter 74 | Copper and articles thereof |

| Chapter 75 | Nickel and articles thereof |

| Chapter 76 | Aluminum and articles thereof |

| Chapter 77 | (Chapter 77 is reserved for future international use by World Customs Organization - WCO) |

| Chapter 78 | Lead and articles thereof |

| Chapter 79 | Zinc and articles thereof |

| Chapter 80 | Tin and articles thereof |

| Chapter 81 | Other base metals; cermets; articles thereof |

| Chapter 82 | Tools, implements, cutlery, spoons and forks, of base metal; parts thereof of base metal |

| Chapter 83 | Miscellaneous articles of base metal |

| SECTION XVI | Machinery and Mechanical Appliances; Electrical Equipment; Parts Thereof; Sound Recorders and Reproducers, Television Image and Sound Recorders and Reproducers, and Parts and Accessories of Such Articles |

| Chapter 84 | Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof |

| Chapter 85 | Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles |

| SECTION XVII | Vehicles, Aircraft, Vessels And Associated Transport Equipment |

| Chapter 86 | Railway or tramway locomotives, rolling-stock and parts thereof; railway or tramway track fixtures and fittings and parts thereof; mechanical (including electro-mechanical) traffic signalling equipment of all kinds |

| Chapter 87 | Vehicles other than railway or tramway rolling stock, and parts and accessories thereof |

| Chapter 88 | Aircraft, spacecraft, and parts thereof |

| Chapter 89 | Ships, boats and floating structures |

| SECTION XVIII | Optical, Photographic, Cinematographic, Measuring, Checking, Precision, Medical or Surgical Instruments and Apparatus; Clocks and Watches; Musical Instruments; Parts and Accessories Thereof |

| Chapter 90 | Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof |

| Chapter 91 | Clocks and watches and parts thereof |

| Chapter 92 | Musical instruments; parts and accessories of such articles |

| SECTION XIX | Arms And Ammunition; Parts And Accessories Thereof |

| Chapter 93 | Arms and ammunition; parts and accessories thereof |

| SECTION XX | Miscellaneous Manufactured Articles |

| Chapter 94 | Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; lamps and lighting fittings, not elsewhere specified or included; illuminated sign illuminated nameplates and the like; prefabricated buildings |

| Chapter 95 | Toys, games and sports requisites; parts and accessories thereof |

| Chapter 96 | Miscellaneous manufactured articles |

| SECTION XXI | Works of Art, Collectors' Pieces and Antiques |

| Chapter 97 | Works of art, collectors' pieces and antiques |

Please contact us for your customs tariff schedule and hs code questions.